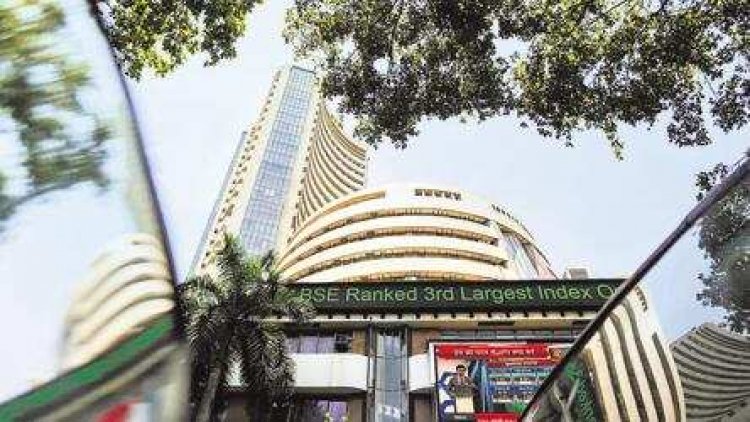

Markets return to winning ways; post weekly gains

Mumbai: The Sensex and Nifty found firmer ground on Friday as investors accumulated energy, infra and IT stocks amid a mixed trend in overseas markets.

Clawing back some lost ground after the previous session's heavy sell-off, the 30-share BSE Sensex ended 142.81 points or 0.24 per cent higher at 59,744.65. Similarly, the broader NSE Nifty rose 66.80 points or 0.38 per cent to close at 17,812.70.

Asian Paints was the top gainer in the Sensex pack, climbing 1.79 per cent, followed by TCS, Nestle India, Ultratech Cement, ICICI Bank, HUL and Reliance Industries.

On the other hand, Bajaj Finserv, M&M, L&T, Bajaj Finance, HDFC, Titan and Bharti Airtel were among the laggards, shedding up to 1.39 per cent.

"Domestic indices erased early gains following weak cues from global peers as markets globally await the Eurozone inflation rate and US payroll data due later today. Strong appetite for healthcare and consumer durable stocks aided the markets in closing flat with a positive bias.

"Although rising Omicron cases and hawkish stance by the US Fed is keeping the market volatile, hopes of favourable earnings season and FIIs switching to net buyers is pumping in optimism into the market," said Vinod Nair, Head of Research at Geojit Financial Services.

On a weekly basis, the Sensex advanced 1,490.83 points or 2.55 per cent, while the Nifty gained 458.65 points or 2.64 per cent.

Ajit Mishra, VP - Research, Religare Broking, said markets are likely to consolidate after the recent surge and it would be healthy.

"... volatility is likely to remain high, citing mixed global cues and COVID-related updates. Besides, upcoming macroeconomic data (IIP, CPI, and WPI) and the beginning of the earnings season could further add to the choppiness. We recommend continuing with a positive yet cautious approach and preferring hedged positions," he noted.

Sector-wise, BSE basic materials, oil and gas, energy, bankex and FMCG indices rose as much as 1.33 per cent, while capital goods, telecom, consumer durables and healthcare closed lower.

Global markets were mixed ahead of key US jobs data, which will give cues on the Federal Reserve's rate hike trajectory.

Elsewhere in Asia, bourses in Hong Kong and Seoul ended with gains, while Shanghai and Tokyo were in the red.

Stock exchanges in Europe were trading on a mixed note in mid-session deals.

International oil benchmark Brent crude advanced 0.94 per cent to USD 82.76 per barrel.

The rupee gained 8 paise to close at 74.34 against the US dollar on Friday, tracking positive domestic equities.

Foreign institutional investors (FIIs) were net sellers in the capital market on Thursday, as they sold shares worth Rs 1,926.77 crore, according to stock exchange data.