IDFC FIRST Bank Profit After Tax up 18% YOY at Rs. 716 Crore for Quarter Ending on 31 December 2023, up 37% YoY at Rs. 2,232 Crore for 9 Months

Mumbai: Financial results at a glance - The Board of Directors of IDFC FIRST Bank, in its meeting held today, approved the unaudited financial results for the quarter and nine months ended December 31, 2023.

Profitability

* Net Profit grew 18% YOY from Rs. 605 crore in Q3-FY23 to Rs. 716 crore in Q3-FY24.

* Net Interest Income (NII) grew 30% YOY from Rs. 3,285 crore in Q3-FY23 to Rs. 4,287 crore in Q3-FY24.

* Net interest Margin (gross of IBPC and sell-down) was 6.42% in Q3-FY24 as compared to 6.13% in Q3-FY23 and 6.32% in Q2-FY24.

* Fee and Other Income grew by 32% YoY from Rs. 1,117 crore in Q3-FY23 to Rs. 1,469 crore in Q3-FY24. Retail fees constitute 93% of the overall fees for the quarter Q3-FY24.

* Core Operating income (NII plus Fees, excluding trading gains) grew 31% from Rs. 4,402 crore in Q3-FY23 to Rs. 5,755 crore in Q3-FY24.

* Operating Expense grew by 33% YoY from Rs. 3,177 crore in Q3-FY23 to Rs. 4,241 crore in Q3-FY24.

* Core Operating Profit (pre provision operating profit excluding trading gains) grew by 24% YOY from Rs. 1,225 crore in Q3-FY23 to Rs. 1,515 crore for Q3-FY24.

* Provisions increased 45% YOY from Rs. 450 crore in Q3-FY23 to Rs. 655 crore in Q3-FY24. The credit cost (quarterly annualized) as % of average funded assets for 9M-FY24 was 1.26%.

* RoA (annualized) stood at 1.16% for 9M-FY24.

* RoE (annualized) stood at 10.67% in 9M-FY24.

Deposits & Borrowings

* Customer Deposits increased by 42.8% YoY from Rs. 1,23,578 crore as of December 31, 2022 to Rs. 1,76,481 crore as of December 31, 2023.

* CASA Deposits grew by 28.6% YoY from Rs. 66,498 crores as of December 31, 2022 to Rs. 85,492 crore as of December 31, 2023. CASA Ratio stood at 46.8% as of December 31, 2023.

* Retail deposits grew by 46.6% YoY from Rs. 95,107 crores as of December 31, 2022 to Rs. 1,39,431 crore as of December 31, 2023.

* Retail deposits constitutes 79% of total customer deposits as of December 31, 2023.

* Legacy High Cost Borrowings reduced from Rs. 18,762 crores as of December 31, 2022 to Rs. 13,607 crore as of December 31, 2023.

Funded Assets

* Funded assets (including advances & credit substitutes) increased by 24.5% YoY from Rs. 1,52,152 crore as of December 31, 2022 to Rs. 1,89,475 crores as of December 31, 2023.

* The Bank continues to wind down infrastructure financing as per the stated strategy and now constitutes only 1.6% of total funded assets as of December 31, 2023.

* Exposure to top 20 single borrowers improved to 5.93% as of December 31, 2023.

* The Credit to Deposit Ratio improved further from 109.18% as of December 31, 2022 to 101.41% crore as of December 31, 2023. The incremental Credit to Deposit ratio for quarter 9M-FY24 was 79.89%.

Assets Quality

* Gross NPA (GNPA) of the bank has improved to 2.04% as of December 31, 2023 from 2.96% of December 31, 2022.

* Net NPA (NNPA) of the bank has improved to 0.68% as of December 31, 2023 from 1.03% of December 31, 2022.

* GNPA of the Retail, Rural and SME Finance has improved to 1.45% as of December 31, 2023 from 1.87% of December 31, 2022.

* NNPA of the Retail, Rural and SME Finance has improved to 0.51% as of December 31, 2023 from 0.70% of December 31, 2022.

* Excluding the infrastructure financing book which the Bank is running down, the GNPA and NNPA of the Bank would have been 1.66% and 0.47% respectively as of December 31, 2023.

* SMA-1 and SMA-2 (31-90 DPD which is the pre-NPA stage) in Retail, Rural and SME Finance portfolio has reduced from 0.87% as of March 31, 2023, to 0.85% as of December 31, 2023.

* Collection efficiency for urban retail business (excluding prepayments and EMI arrears) in current bucket continues to remain high at 99.6%.

* Provision coverage ratio (including technical write-off) of the bank has increased to 84.68% as of December 31, 2023 from 76.60% as of December 31, 2022.

* Standard restructured book as % of total funded assets improved to 0.35% at December 31, 2023.

Capital Position & Liquidity

* Capital Adequacy of the Bank was strong at 16.73% with CET-1 Ratio at 13.95% as on December 31, 2023. The Bank raised fresh equity capital of Rs. 3,000 crore in 1st week of October 2023.

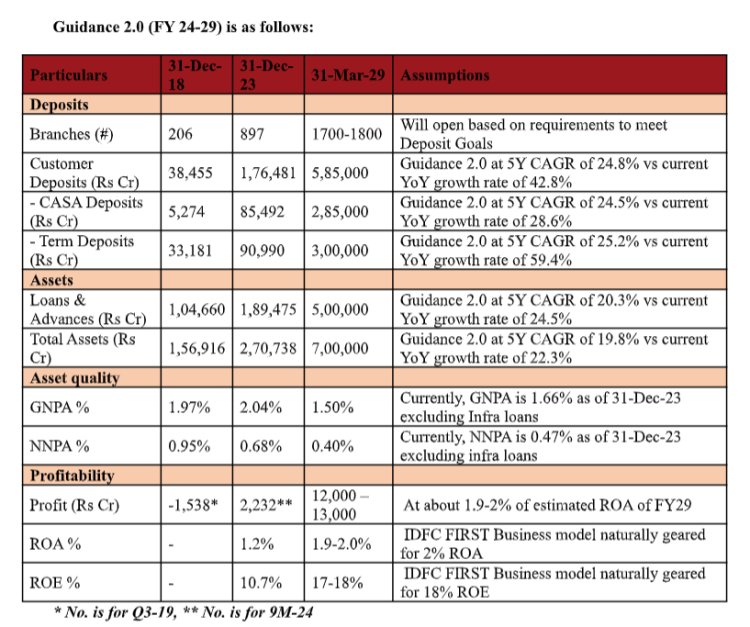

* Average LCR was strong at 121% for the quarter ending on December 31, 2023. Guidance 2.0 for the next 5 Years (FY2024 to FY 2029)

* The Bank has exceeded, met, or is most likely to meet most targets as provided under Guidance 1.0.

* We have a strong proven business model that is incrementally very profitable. Basis this model, we could do necessary investments and expenses for building the Bank, and yet grow profitability during FY 19-24. We have far greater visibility while providing Guidance 2.0 as compared to visibility of at time of Guidance 1.0

* We are building a world class bank with highest levels of corporate governance, a consistent balance sheet growth of ~20%, with strong asset quality of GNPA < 1.5% and net NPA of < 0.4%, with ROE of 17-18%, with contemporary technology, unique business model, and high levels of Customer Centricity.

Comments from Managing Director & CEO

V Vaidyanathan, Managing Director and CEO, IDFC FIRST Bank, said,

"We are happy to share that our deposits continue to grow strongly at 43% YOY, and our CASA ratio continues to be strong at 46.8%. Our asset quality continues to improve. On the Retail, Rural & SME business, which is a significant part of our business, the Gross NPA and Net NPA continue to remain low and are at 1.45% and 0.50% respectively as of 31st December 2023. We will remain very watchful on this front all the time.

We have registered profit of Rs. 2,232 crores in 9M-FY24, representing a growth of 37% over PAT of Rs. 1,635 crores in 9M-FY23.

At the time of the merger of IDFC Bank and Capital First, the Bank provided Guidance 1.0. As of 31st December 2023, IDFC FIRST Bank has completed exactly 5 years post the merger and hence we are providing Guidance 2.0 (FY 24-29), with greater visibility as compared to the visibility we had at time of providing Guidance 1.0. We are likely to meet most targets under Guidance 1.0."