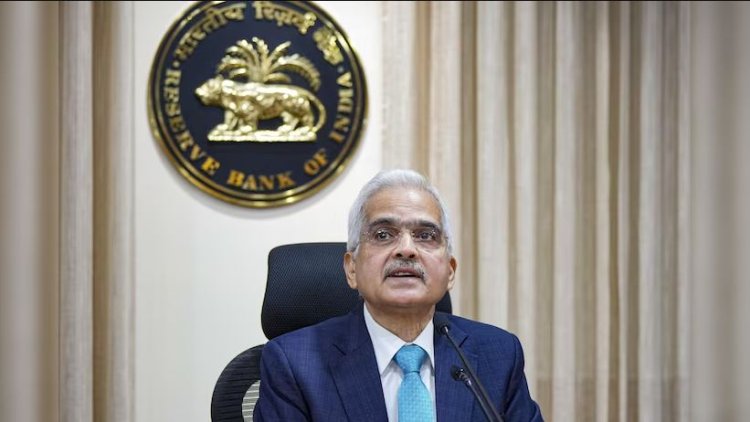

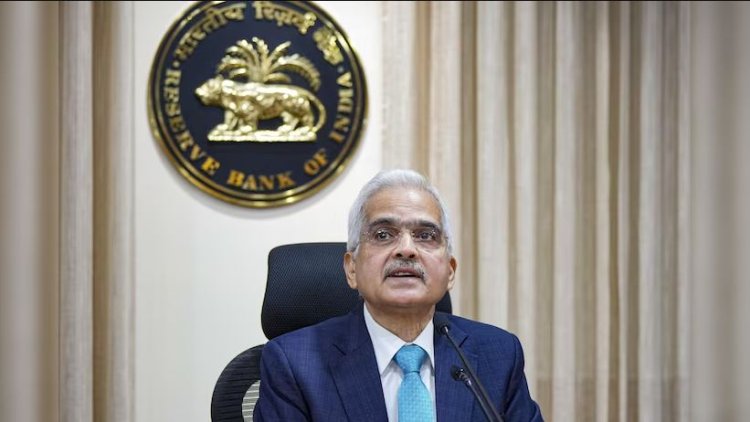

Mumbai: Banks need to re-strategise their business to deal with the persistent gap between credit and deposit growth, RBI Governor Shaktikanta Das said on Friday.

He also said that further actions on moderating growth in unsecured loans could be taken, if required.

In November last year, RBI had flagged certain concerns on excessive growth in the unsecured retail loans and over-reliance of NBFCs on bank funding.

"Recent data suggests that there is some moderation in these loans and advances. We are closely monitoring the incoming data to ascertain if further measures are necessary," he said while announcing the bi-monthly policy.

"The message is to convey that RBI is watchful of every aspect of financial sector especially in the banking sector. We are agile, we are watchful and if and when some further measures are required, we will come," he said during an interaction with reporters.

The Reserve Bank increased risk weights on unsecured consumer credit and bank credit to NBFCs on November 16, 2023 to pre-empt build-up of any potential risk in these segments.

Consequently, credit growth in unsecured personal loans such as 'credit card outstanding' declined from 34.2 per cent in November 2023 to 23 per cent in April 2024, while bank credit growth to

NBFCs declined from 18.5 per cent in November 2023 to 14.4 per cent in April 2024.

Das said that the boards and top management of regulated entities should ensure that risk limits and exposures for each line of business are kept well within their respective risk appetite framework.

"The persisting gap between credit and deposit growth rates warrants a rethink by the boards of banks to re-strategise their business plans. A prudent balance between assets and liabilities has to be maintained," he said.

Stressing that customer protection remains on top of the Reserve Bank's priorities, he said RBI has observed that guidelines on Key Facts Statement (KFS) are followed in general, but a few regulated entities (RE) still charge fees, etc. that are not specified or disclosed in the KFS.

It has also been observed in some micro finance institutions and NBFCs that the interest rates on small value loans are high and appear to be usurious, he said.

The regulatory freedom enjoyed by the REs in respect of interest rates and charges should be used judiciously to ensure fair and transparent pricing of products and services, he said.

The Reserve Bank continues its constructive engagements with such financial entities to safeguard the interest of customers and ensure overall financial stability, he added.