Kotak Securities picks eight stocks, sees 10-26% potential returns

New Delhi, India: Kotak Securities is bullish on a few select large-cap and BFSI sector stocks and advised investors to add quality stocks to their portfolio at a time when the broader market valuations are relatively rich.

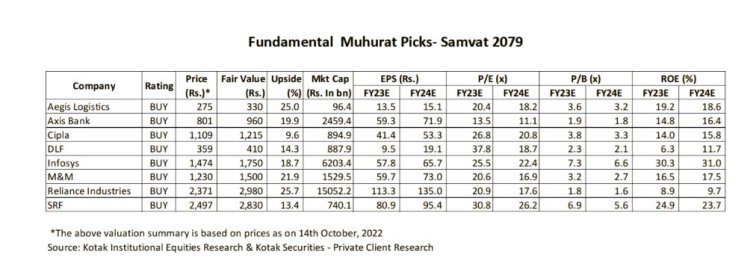

Opportunities arising from market correction should be used, the brokerage said in a report 'Diwali Muhurat Picks'. It gave 'Buy' recommendations for eight stocks - Aegis Logistics, Axis Bank, Cipla, DLF, Infosys, Mahindra and Mahindra, Reliance Industries, and SRF. It sees a 10-26 per cent possible return on investments in these recommended stocks over the course of the next 12 months.

According to the brokerage, the recent sharp correction in stock prices may reflect growing recognition of short-term and medium-term challenges or a 'natural' correction in the market from 'high' levels.

"In our view, large-cap stocks offer better reward-risk balance given more reasonable valuations versus lofty valuations of most mid-and small-cap stocks," Kotak Securities said.

For Reliance Industries where it sees 26 per cent potential returns, Kotak Securities argued that the Mukesh Ambani company can explore reorganization of the company into three independent entities for its three different business verticals.

Reorganization, it said, will help the company in achieving three mutually linked objectives - structure, succession, and segregation.

"We assume RIL will list its retailing (Reliance Retail and related entities) and telecommunications (Jio Platforms and related entities) over the next 2-3 years," Kotak Securities said.

For Mahindra and Mahindra, Kotak Securities pegs 22 per cent returns on investments.

"Given the strong order book on account of successful new launches, we expect the automotive segment to deliver a strong performance in the coming quarters," the brokerage report said, adding it expects mid-single-digit growth in tractor segment volumes.

For Infosys, Kotak Securities said the IT services major will be at the forefront of driving the digital journey of clients.

"Infosys' strength in managing the twin journeys of digital transformation and cost takeout will drive growth leadership," it noted.