Go Airlines (India) operates one of the youngest fleets of any LCCs in the world

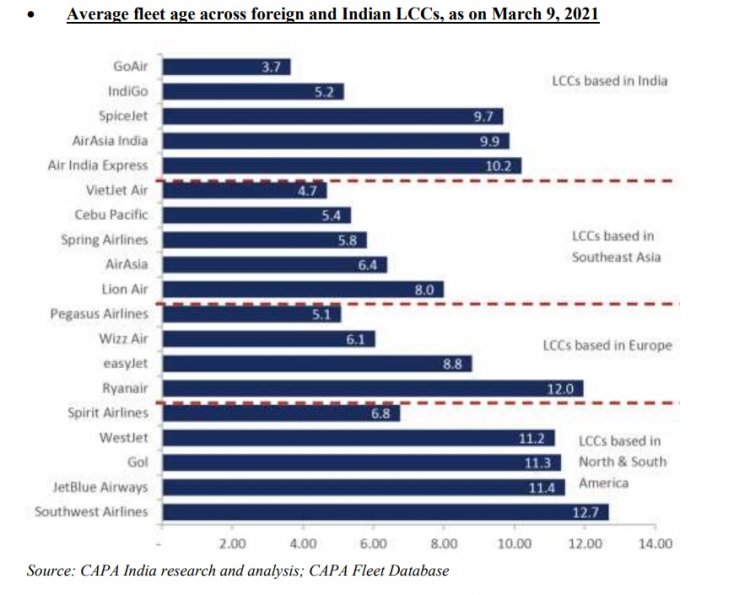

With an average age of 3.7 years, Go Airlines (India) Limited not only has the youngest fleet of any Indian LCC (Low Cost Carriers), but it is lower than the peer group of the world’s leading LCCs.

Go Airlines, an Ultra Low Cost Carrier (ULCC), has the highest percentage of next generation aircraft in its fleet compared to other Indian airlines. (Source: CAPA Report). A320 NEOs are 17-20% more fuel-efficient than A320 CEOs and constitute 82% of its fleet size (as of February 10, 2021). By the end of fiscal 2024, its fleet will solely comprise A320 NEO aircrafts.

Go Airlines has placed firm orders for delivery of 144 Airbus A320 NEO aircraft as part of its growth plan. It has taken delivery of 46 Airbus A320 NEO aircraft while still awaiting delivery of 98 Airbus A320 NEO aircrafts. Recently, the Company re-branded the airline to “GO FIRST” to target large customer base of young Indian leisure and MSME travellers.

With a view to expanding its network density, Go Airlines India expects 14 NEO aircraft to be delivered in fiscal 2023 and 14 in fiscal 2024 with the balance 64 NEO aircraft in the order book to be delivered from fiscal 2025 onwards.

Go Airlines established strong positions in slot-constrained airports such as New Delhi, Mumbai, Ahmedabad and Pune. As of January 31, 2020, it covered a network of 28 domestic and nine international destinations.

As of February 10, 2021, its fleet inventory consisted of 56 aircraft, of which 46 aircraft were A320 NEO models and 10 were A320 CEO models. It offers a single class of service, which allows A320 aircraft to have the maximum seating capacity.

As an Ultra Low Cost Carrier (ULCC), Go Airlines is focused on maintaining a low-cost base and high utilization of its modern and fuel-efficient fleet. It has the highest percentage of next generation aircraft in its fleet in India. (Source: CAPA Report).

Go Airlines endeavours to expand its network breadth selectively in high revenue markets such as Middle East, South East Asia in the international markets and on some of the high demand markets in India like Srinagar, Leh, Ranchi and Goa among others. It aims to leverage its leadership position in key slot-constrained airports to further enhance route density while expanding to additional locations within India.

According to CAPA, between fiscal 2010 and fiscal 2020, the domestic air travel passenger market in India has grown at a CAGR of 11.9% and the international air travel passenger market has grown at a CAGR of 6.8%. With very low seat capacity per capita, a low number of total airline passengers, a highly underpenetrated total fleet size and the ability to provide an alternative to lengthy rail travel, the Indian 138 aviation market has grown from 76 million passengers in 2010 to 208 million passengers in 2020, which is the fastest growing aviation market globally. (Source: CAPA Report).

Go Airlines’ passenger volume increased at a CAGR of 22.4% from 1.08 crore passengers in fiscal 2018 to 1.62 crore passengers in fiscal 2020. Its market share of domestic passenger volume increased from 8.8% in fiscal 2018 to 10.8% in fiscal 2020. Further, in the current fiscal year, it added three new A320 NEOs to its network to support the expected growth in demand.

Go Airlines has a strong focus on operational efficiency and reliability to deliver a superior customer experience relative to other ULCCs and LCCs. It had high aircraft utilization during fiscal 2020, with an average utilization of 12.9 hours per day with a high load factor of 88.9%. (Source: CAPA Report). Its focus on these parameters allowed it to achieve the best on-time performance among airlines in India for 15 consecutive months between September 2018 and November 2019, the least number of cancellations, at 0.3%, for fiscal 2021 as of January 31, 2021, and the lowest number of customer complaints of 0.3 per 10,000 customers (as against the industry average of 1.0 per 10,000 customers) in fiscal 2021 for the period up to January 31, 2021. (Source: CAPA Report).